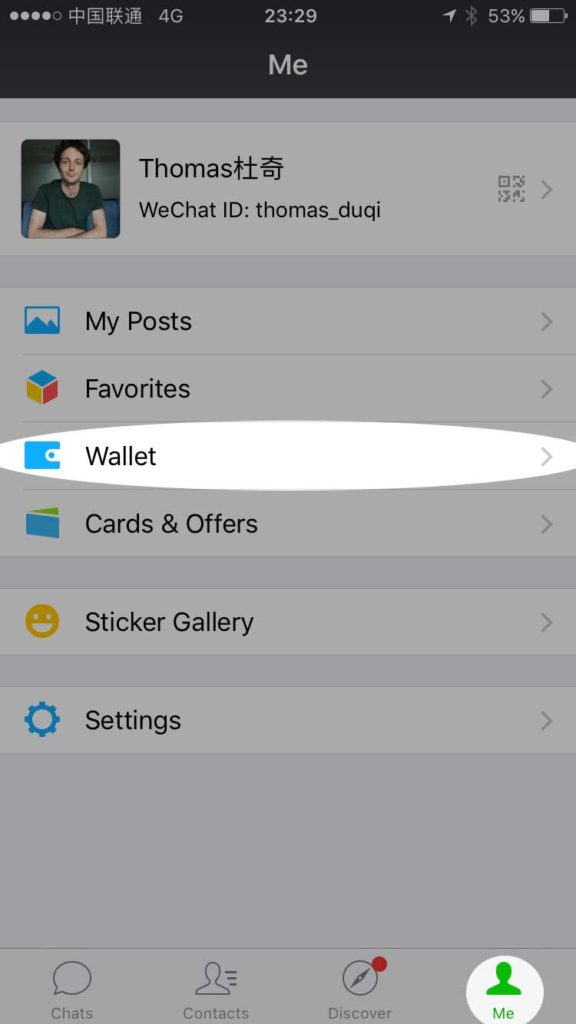

The default local currency for WeChat Pay is cny and customers also see their purchase amount in cny. Planets Risk Management services offer acquirers customised system access controls and a suite of tools and alerts to minimise risk and decrease fraud for. You can create WeChat Pay payments in the currencies that map to your country. You will then need to arrange an alternative way of providing your customer with a refund. Partner of Alipay and WeChat Pay, Silkpay offers you the opportunity to accept these most popular means of payment. In the rare instance that a refund fails, the Refund object’s status transitions to failed and Stripe returns the amount to your Stripe balance. When a refund succeeds, the Refund object’s status transitions to succeeded. With large numbers of older people using WeChat, experts warn that a growing risk of online payment fraud could follow, since seniors are more vulnerable and more easily influenced. Stripe notifies you of the final refund status using the webhook event. It appears in the WeChat Wallet section of the application.

Refunds for WeChat Pay payments are asynchronous. WeChat pay is a payment solution completely integrated inside the social and messaging application of Tencent: WeChat. After 180 days, it is no longer possible to refund the charge. To start a WeChat Pay sale transaction, you, the merchant, must scan the barcode displayed on the shoppers WeChat Pay wallet app. Payments made with WeChat Pay can only be submitted for refund within 180 days from the date of the original charge. Many victims look to their banks or payment service providers for compensation. The vast majority of funds lost are never recovered from the perpetrators of the fraud, leaving consumers and businesses out of pocket. Therefore, there is no dispute process that can result in a chargeback and funds being withdrawn from your Stripe account. Authorised Push Payment ( APP) Fraud resulted in £479m in losses in 2020. WeChat Pay is linked to users’ Chinese bank accounts and/or Visa, MasterCard, or JCB cards. WeChat payments have a low risk of fraud or unrecognized payments because the customer must authenticate the payment via the WeChat Pay app.

Wechat payment fraud how to#

If your integration requires manually listing payment methods, learn how to manually configure WeChat Pay as a payment. The following Stripe products also support adding WeChat Pay from the Dashboard: Checkout, a prebuilt, hosted checkout pageĪfter setting up your payment form, activate the payment methods you want in the Stripe Dashboard.Follow a quickstart for one of our hosted UIs: If you use our front-end products, Stripe automatically determines the most relevant payment methods to display. You don’t actually have to integrate WeChat Pay and other payment methods individually. Partial (request an invite to create charges on behalf of other accounts) If you suspect that your WeChat account has been compromised, try using the following methods to protect your account: 1.

So what exactly is WeChat Pay and how does it work? Here are 10 things you need to know about it now, as presented at the recent Money 20/20 conference in Las Vegas.Chinese consumers, overseas Chinese, and Chinese travelersĬNY, AUD, CAD, EUR, GBP, HKD, JPY, SGD, USD, DKK, NOK, SEK, CHF (depending on business location)

First launched in 2013, WeChat Pay now holds 40 per cent of the mobile payment market share in China. The fraudster poses as your known vendor and sends you a request by email, phone or letter to change the payment. This steep growth trajectory is made possible largely due to the market’s two main mobile payment players – one of which is tech giant Tencent, with its WeChat Pay service. Vendor invoice payment fraud is increasing. In fact, a 36 per cent growth in non-cash transactions within the Middle Kingdom is projected over the next five years.

Wechat payment fraud full#

However, analysts have predicted that China will be the first country to reach a full cashless state thanks to its high uptake of mobile payment options. Presently, the Nordic territories are at the forefront of this transition (Sweden sees less than two per cent of all its transactions in cash). According to the recent World Payments Report 2017 by technology consulting firm Capgemini and banking group BNP Paribas, the number of global non-cash transactions will increase at a compound annual growth rate of 10.9 per cent until 2020, at which it will hit 726 billion.

0 kommentar(er)

0 kommentar(er)